Outstanding Projects

Our inclusive project management approach has yielded tangible results in both low and high capacity environments.

Numbers don’t lie

Sogema Technologies can help you reach new heights you never thought possible. Discover how our technology helps our clients rise and lead your people with complete confidence towards financial transparency.

Case studies

Republic of Liberia

Results

Thirty-three thousand taxpayers are now managed through SIGTAS, which collects over $330M US per year in tax revenue. Two years after SIGTAS' implementation, LRA has registered 1100% increase in revenue collection

Products

- SIGTAS

- Integrated Workflow Management System

- Property Tax Management System

Services

- Software Implementation Feasibility Studies

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Product Maintenance

- Post Implementation Support

- Software and Hardware Procurement.

Supply and Installation of Integrated Tax Administration System (ITAS)

Following the decision to replace the Liberian Tax Administration System, SIGTAS was selected and implemented at the Liberia Revenue Authority. The project goal was to increase compliance and domestic revenue in implemening SIGTAS at the LRA, including PTMS and IWMS (Intergrated Workflow Management System). SIGTAS and PTMS were implemented in the Large Taxpayer Office (LTO), the Medium Taxpayer Office (MTO) and the Small Taxpayer Office (STO), as well as a number of rural revenue offices. In addition, our proprietary, Integrated Workflow Management System (IWMS), was developed, which is linked to SIGTAS and implemented for the first time, allowing better control over operations. Thirty-three thousand taxpayers are now managed through SIGTAS, which collects over $330M US per year in tax revenue. Two years after SIGTAS' implementation, LRA has registered 1100% increase in revenue collection.

Federal Democratic Republic of Ethiopia

Products

- SIGTAS

- Integrated Value Added Tax (VAT) Management System

Services

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Post Implementation Support

Results

During this period, the ERCA has tripled revenue collection from 11.2 billion birr in 2006 to 35.6 billion birr in 2010. Consequently the contribution of the revenue to covering the federal government's expenditure had considerably grown from 37.54% in 2006 to 55.35% in 2010.

The Study, Supply, Implementation of a value Added Tax Information System, Phase 1

FIRA is the Ethiopian agency responsible for collection of both Taxes and Custom duties.The objective of the first phase of the project was to implement the Standard Integrated Government Tax Administration System (SIGTAS) in order to automate the administration of the Value Added Tax (VAT) for the entire country (city of Addis Ababa and the regional offices). The overall project goal aimed to modernize the fiscal administration, improve efficiency and increase tax revenues. The existing VAT processes were analyzed and SIGTAS was customized to support the automation of the Ethiopian VAT. Administrative procedures were drafted, testing and training were conducted, and SIGTAS was successfully implemented at FIRA for the administration of the VAT. A one-year maintenance period was included at the end of this project which concluded the project known as Phase 1. After the end of the first phase in 2004, the VAT management system was implemented at the Addis Ababa Large Tax Office and was used for managing all VAT tax returns and payments. As published on the ERCA (former FIRA) website: “Since 2006, great strides in automating ERCA's operations had been made, hence ERCA's daily operation has become improved and service delivery to importers, exporters, taxpayers and other customers has become a lot easier. The ERCA has witnessed success in revenue collection over the past five years beginning from 2006. During this period, the ERCA has tripled revenue collection from 11.2 billion birr in 2006 to 35.6 billion birr in 2010. Consequently the contribution of the revenue to covering the federal government's expenditure had considerably grown from 37.54% in 2006 to 55.35% in 2010.

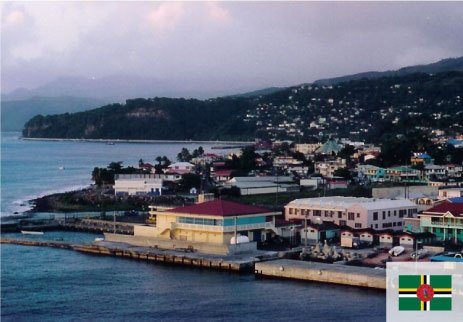

Commonwealth of Dominica

Products

- SIGTAS

Services

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Post Implementation Support

- Software and Hardware Procurement

Client

- Inland Revenue Department

Results

As a result of the succesful project execution, each of the countries have increased significantly their tax compliance and domestic revenue. Dominica's Tax-to-GDP ratio went from 12% in 1992 to 17.6% in 2001 while St. Vincent's Tax-to-GDP ratio went from 12% in 1991 to 20.8% in 2001.

Funding Agency

Canadian International Developing Agency

Eastern Caribbean Economic Management Programme, Phase II

The Organisation of Eastern Caribbean States (OECS) in junction with the Eastern Caribbean Central Bank (ECCB) requested assistance from the Canadian International Development Agency (CIDA) for the economic development of the 6 OECS participating countries, namely Antigua, Dominica, Grenada, St. Kitts & Nevis, St. Lucia and St. Vincent. The ultimate goal was to improve the economic and social development of these countries in increasing their domestic revenue and in providing better services to their population through their social expenditures. On the project component to improve domestic revenue, STI identified, in support of the 6 tax (Inland Revenue) departments, their automation requirements. With these requirements, STI designed and developed SIGTAS (Standard Integrated Government Tax Administration System), performed a formal Business Process Re-engineering exercise (leading to new procedures, new tax forms and new instructions), trained the client’s resources, procured the hardware and telecommunication equipment, implemented the software solution and provided post-implementation support with much success. On the Public Expenditure Management component, STI documented the client’s requirements (especially on the Financial Management Information System (FMIS)), established the Terms of Reference for Calls to Tenders, assisted the 6 countries' Treasury Departments in selecting the vendors and monitored the selected FMIS vendors (SmartStream, 4GEN and Fitrix) implementation. As a result of the succesful project execution, each of the countries have increased significantly their tax compliance and domestic revenue. For example, Dominica's Tax-to-GDP ratio went from 12% in 1992 to 17.6% in 2001 while St. Vincent's Tax-to-GDP ratio went from 12% in 1991 to 20.8% in 2001. On the public expenditure side, most countries were now able to present accurate public accounts to Parliament on-time; improve the public discussion about government spending during budget periods; and were held more accountable by the Auditor General department.

Islamic Republic of Afghanistan

Solutions

- SIGTAS

- Integrated Value Added Tax Management System (IVATS)

Services

- Product Development

- Product Implementation

- Capacity Building / Training

Client

- Afghanistan Revenue Department

Results

The implementation of SIGTAS helped the LTO and MTO to increase their revenues. The MTO's revenues in the 3 first quarters of 2013-2014 increased by 12% compared to the previous year.

Funding Agency

Department for International Development, DFID

Strengthening National and Provincial Tax Administration Project - Implementation of Tax Administration Software

In order to help Afghanistan rebuild their country, DFID financed a large reform for several ministries, including the Ministry of Finance. The modernization of the Afghanistan Revenue Department (ARD) was part of this reform. The objective of the project was to implement our tax administration software, SIGTAS, at the Large Taxpayers Office (LTO) and the Medium Taxpayers Office (MTO) in Kabul, moving them from a "paper and pen" system to a fully automated one. SIGTAS was implemented in both tax centres for all taxes, helping to strengthen both the processes and the tracking of non-compliant taxpayers. A follow-up project was done afterwards to implement the IVATS application to support the ARD's new VAT, which is planned to go live in 2016. The implementation of SIGTAS helped the LTO and MTO to increase their revenues. The MTO's revenues in the 3 first quarters of 2013-2014 increased by 12% compared to the previous year.

Republic of Kosovo

Products

- SIGTAS

- Integrated Value Added Tax (VAT) Management System

Services

- Product Development

- Product Implementation

- Capacity Building / Training

- Post Implementation Support

Results

Since the initial deployment, SIGTAS has helped the Tax Administration of Kosovo to collect 21.7% of GDP as tax revenues.

SIGTAS Stabilization, Modernisation, Upgrade and Support

After Kosovo’s independence from Serbia in 2000, the Government of Kosovo proceeded with the modernisation of its tax administration system. After a first project in which SIGTAS core modules were implemented, the Government of Kosovo issued STI a second contract aiming to update SIGTAS ith a newly adopted tax legislation. The project objective was to upgrade SIGTAS, migrate transactional data and database from Oracle 6i to Oracle 10g, increase the system operational performance, develop new functionalities, train users and technical staff and to benefit from a two-year maintenance and support services. Some of the new functionalities that have been implemented were the “Back-dated payments” functionality in the Cashing module, the “freezing” procedure of the refund when calculating excess VAT amounts that are carried forward, a US-like instalment scheme, and new ways of calculating penalties and interest. During the project, the database had been upgraded and the transactional data has been migrated, a challenging endeavour because of important architectural changes between the two versions. The user interface had also been modernized and a 'train-the-trainer approach", BPR and technical training had been provided to functional users, DBAs and programmers respectively. Since the initial deployment, SIGTAS has helped the Tax Administration of Kosovo to collect 21.7% of GDP as tax revenues.

Lebanese Republic

Products

- Integrated Title Registry System

Services

- Software Implementation Feasibility Studies

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Software and Hardware Procurement

Results

Sogema has developed a process and an automated conversion system that allowed the capture of the 2.5 million property titles which made them available for processing.

Revenue Enhancement and Fiscal Management

Cadastre Operations Modernisation and Automation Project, Phase 1

The Lebanese Government, managed through the Directorate General of Land Registry and Cadastre (DLRC) of the Ministry of Finance, is responsible to ensure collecting the taxes on an estimated 2.5 million properties spread across 8 registration offices in Lebanon. The goal of the project was to improve accessibility, efficiency and transparency in property transactions in the Land of the Cedars. This project consisted of inventorying, restoring, photographing and electronically computerizing all property titles and its content (more than 10 million pages in A0 format). STI has developed a process and an automated conversion system that allowed the capture of the 2.5 million property titles which made them available for processing. The Integrated Title Registry System (ITRS) was subsequently developed and implemented in eight registry offices of the country, which allowed land registrars to electronically manage property taxes. The system allowed archiving on microfilm and especially allowed conservation of an electronic copy of all property titles, preserving the title history for Lebanon since 1926. Moreover, the system allowed to digitalize all work done by land registrars, increasing their efficiency and decreasing the delays due to land transactions. It was also made possible for lawyers/notaries in Lebanon to electronically search for title registrations, increasing their efficiency. Finally, the system allowed the Government to increase revenues linked to land transactions and to cover a part of the costs linked to its role of fiduciary guarantor of these transactions.

Federal Republic of Nigeria

Products

- SIGTAS

- e-TAX

- Integrated Workflow Management System

Services

- Software Implementation Feasibility Studies

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Post Implementation Support

- Software and Hardware Procurement

Results

As of June 2015, up to 600 000 taxpayers are registered in the system. One Hundred Sixty Large Taxpayers have filed tax returns in the system executing close to 4 000 transactions so far. In addition, more than 600 people were trained in the use of the system in the State's board of internal revenue and FIRS.

The design, supply, installation, implementation of and provision of support services for a web enabled integrated tax administration system (ITAS) based on SIGTAS solution for FIRS

The Federal government of Nigeria through the Federal Inland Revenue Service (FIRS) requested the implementation of a new Integrated Tax Administration System to manage all federal taxes for more than 5 million taxpayers. The project consisted in the supply, installation, implementation and provision of post-implementation support services for a web-enabled Integrated Tax Administration System (ITAS) based on the SIGTAS solution. The project's main goal was to improve FIRS' tax administration process for all federal taxes. The solution was implemented as a centralized solution with client access available across the entire Federation of Nigeria territory, supporting 157 FIRS offices in all aspects of tax administration, such as taxpayer registration, declaration processing, assessments (including instalments and withholding credits), enforcement, collection case management, cashing, penalty and interest calculation, audit (risk-based selection and case management) and revenue accounting. The solution has been integrated with JTB's Unique Taxpayer Identification System (UTIN) based on SIGTAS' registration and biometric integrated modules. The solution has also been integrated with the IWMS, which is STI’s Integrated Workflow Management System.

Network and data replication is up and running between the 25 states and the data is replicated in “real time” to the central database located in Abuja. More than 4 000 database transactions are replicated to the central database every day. As of June 2015, up to 600 000 taxpayers are registered in the system. One Hundred Sixty Large Taxpayers have filed tax returns in the system executing close to 4 000 transactions so far. In addition, more than 600 people were trained in the use of the system in the State's board of internal revenue and FIRS. Pre-existing data from approximately 1 million taxpayers were evaluated and cleaned up before uploading them into the system. As part of this process, a large number of duplicates and dormant taxpayers were identified and more than 20 000 tax accounts were evaluated. The taxpayers related to these tax accounts are now filing taxes through the web filing system.

The Federation of Saint Christopher and Nevis

Products

- SIGTAS

Services

- Software Implementation Feasibility Studies

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Post Implementation Support

Client

- Ministry of Finance, Department of Budget

Results

The implementation of our integrated solution allowed the Government to increase the quality of the budget estimates through more accurate provisions and better planning, to increase Parliament’s role and participation in outlining public finance strategy, in setting priority objectives for the next budget year and in public debates on the use of public funds and to provide the Public greater access to more transparent and improved budget information.

Funding Agency

Canadian International Developing Agency

Eastern Caribbean Economic Management Programme, Phase III - Strengthening Budget Preparation

Saint Christopher and Nevis breached with the tradition of expenditure-oriented budget by drawing up a programme budget and performance management during Eastern Caribbean Economic Management Programme – Phase II. However, the Government in its willingness to further increase Departments autonomy and commitment to their goals and responsibilities, to require of Program Managers greater accountability for their management via results indicators and target values and to increase social and economic effectiveness, quality of public service, delivery and efficiency to the population decided to proceed with the strengthening and automation of its budget preparation process. The ultimate project goal was to further enhance government transparency in budget allocation through improved budget presentation and government accountability through performance and responsibility-oriented budgeting. The main project activities were oriented towards refining of the Government activity structure to pass towards a more meaningful aggregation of activities that support optimal public fund management and reflect the political aims, setting clearly identified goals, annual objective, performance indicators, expected results and spending for each activity and identifying the reporting sources to measure the achieved results and implementing an automated information tool thereby strengthening the budget cycle, reducing the manual budget consolidation and enforcing the reform’s elements. The implementation of our integrated budget preparation software solution SIGBUD allowed the Government to increase the quality of the budget estimates through more accurate provisions and better planning, to increase Parliament’s role and participation in outlining public finance strategy, in setting priority objectives for the next budget year and in public debates on the use of public funds and to provide the Public greater access to more transparent and improved budget information.

Republic of Senegal

Products

- SIGTAS

- Integrated Value Added Tax (VAT) Management System

Services

- Software Implementation Feasibility Studies

- Business Process Reegineering

- Product Development

- Product Implementation

- Capacity Building / Training

- Software and Hardware Procurement

Results

SIGTAS contributed to an increase in Tax-to-GDP ratio to 20,1 % in 2007.

Senegal’s Resource Mobilization Support Projet

Following the successful deployment of SIGTAS at the DGID, the PAMORS project (Phase 2) was designed to include multiple components of support to the Senegalese tax administration. Several consulting services are also part of the project which covers the reinforcement of critical functions of the tax administration, such as auditing, debt recovery and internal control. STI experts will be deployed to Dakar for a period up to two years to provide knowledge transfer and capacity building in critical tax administration areas. The project aims to integrate several new features in SIGTAS, most importantly, upgrading SIGTAS's front-end using the ORACLE APEX technology which provides a more intuitive and responsive user interface and lowers the total cost-of-ownership as part of the release of SIGTAS 3.0. In addition to the new UI, additional features, such as integration with major 3rd party reporting/BI solutions, an Integrated Case Management feature, and major improvements to the Motor Vehicle module are planned. Also, the deployment of the eTax suite’s eFiling and ePayment portions as well as the Workflow application are included in the project. Finally, the project pursues to strengthening the DGID capabilities by providing technical training sessions and technical support to DGID's critical areas of operation such as auditing, debt recovery and internal control. The project has seen the deployment of the eFiling application for the large taxpayers. Access will be progressively opened to additional groups of taxpayers as the project continues.

Customization and Implementation of SIGTAS at the General Tax Directorate (DGID)

The implementation of SIGTAS at the General Tax Directorate (DGID) in Senegal was part of a larger project that dealt with the modernisation of the DGID’s information technology systems. As a first step, Senegal’s Ministry of Economy and Finance mandated STI to produce a feasibility study aimed at identifying the business needs of the DGID based on its level of automation, to assess SIGTAS’ current ability to meet the DGID's requirements, and to examine how the system could eventually be adapted to meet these requirements more comprehensively. Following the feasibility study’s acceptance by the Ministry, the SIGTAS implementation project was initiated. The project’s main goal was to support the DGID’s efforts in implementing an integrated management information system, and to put in place best practices and good governance related to the tax administration. The web-based version of SIGTAS allows the client to manage the country’s main taxes, making it easier to maintain and monitor internal revenues. Computerized links (interfaces) were developed with external partners such as Customs, Public Accounting, and the Ministry of Transportation. The automation of certain specialized processes such as the administration of direct taxes, the management of specific tax suspension programs, the multi-year monitoring of losses declared by corporations, and the direct deferral of credits on the value-added tax (VAT) were integrated to the SIGTAS system during this project. SIGTAS contributed to an increase in Tax-to-GDP ratio from 18,5% in 2004 to 20,1 % in 2007.

Anguilla

Products

- Property Tax Management System

Services

- Product Development

- Product Implementation

- Capacity Building / Training

- Software and Hardware Procurement

Client

- Inland Revenue Department

Results

The new property tax system has been integrated to the GoA tax administration system which allowed consolidated audits, collections and objections case management. The integration also allowed the generation of tax clearance certificate that validates all arrears for all accounts related to a tax payer.

Funding Agency

Government of Anguilla

Implementation of Property Tax System and Coordination of Valuation Survey

Although the Government of Anguilla (GoA) implemented the Standard Integrated Government Tax Administration System (SIGTAS) in 2005 for collection of all taxes as government revenue, the collection of property tax was still administered independently, with only the collected totals being recorded in SIGTAS. Hence, the GoA decided to modernize its property tax approach and to take steps towards best practices executed among some EC States and other developed countries around the world. The project aimed at reviewing the legislation, conducting a valuation survey, recommending a new valuation methodology and processes, proposing algorithms for the mass appraisal of properties and implementing STI’s Property Tax Management System (PTMS). The main project outputs were related to new legislation supporting the implementation of new property value calculation based on a fair algorithm, updated property information for registered properties, new organisational structure, tax procedures and instructions for the newly established Property Tax Unit, mobile application development for property inspections in the field and implementation of PTMS. All properties in Anguilla were surveyed and all their property values were updated. New values like situation, material, use, condition and others were surveyed to be used in the calculation of the new property value. A proposal of a new algorithm for mass valuation was presented and it is under consideration by the Inland Revenue and The Lands and Surveys departments. The new property value in combination with a variable tax rate base is ready to be used for the generation of the new tax bills in 2015. The new property tax system has been integrated to the GoA tax administration system which allowed consolidated audits, collections and objections case management. The integration also allowed the generation of tax clearance certificate that validates all arrears for all accounts related to a tax payer. The tax clearance certificate is now required as a mandatory document for property transfer and other official government administration processes. Since the new law has not been approved yet, the property tax system will continue to support the operations under the current law but can be later modified to accomodate any procedural changes through configuration.

Sogema Techonologies websit uses cookies to provide you with the best possible navigation experience. By proceeding to the site, you authorize us to memorize, and access the cookies on your device. Please visit our Privacy Policy page for more information about cookies and how we use them.